Closure in a Time of Closures: EDPS and RAPS Submissions

The COVID-19 pandemic of 2020 created an unprecedented time of mass closures…businesses, sporting events, school systems; you name it, it is likely closed. However, the business of healthcare is certainly not closed and nor are the businesses that support every aspect of it, including revenue cycle operations. These operations include risk adjustment, and risk adjustment operations are arguably the most important for assuring the financial health of commercial and government health insurance programs during this time. In this article we will discuss another type of closure, but a good kind - risk adjustment gap closure through effective EDPS ad RAPS comparative analytics and implementation of best practices to assure the health of your data submission and risk adjustment programs. By so doing, you have the best chance of successfully solving the business problems of compliance and payment accuracy posed by EDPS and RAPS submissions. We will briefly explore the following topics:

- How the business problems presented by EDPS and RAPS submission are like an iceberg, and how to migrate to proactive vs. reactive strategies for solving them

- How to avoid hitting the iceberg by “working backwards” and closing EDPS/RAPS gaps

- Looking ahead by “working forwards” and using the 12 best practices as a compass to maximize your chance of successfully solving the business problems of compliance and payment accuracy

Problems and Solutions of Titanic Proportions: Where Are We and Where Have We Been?

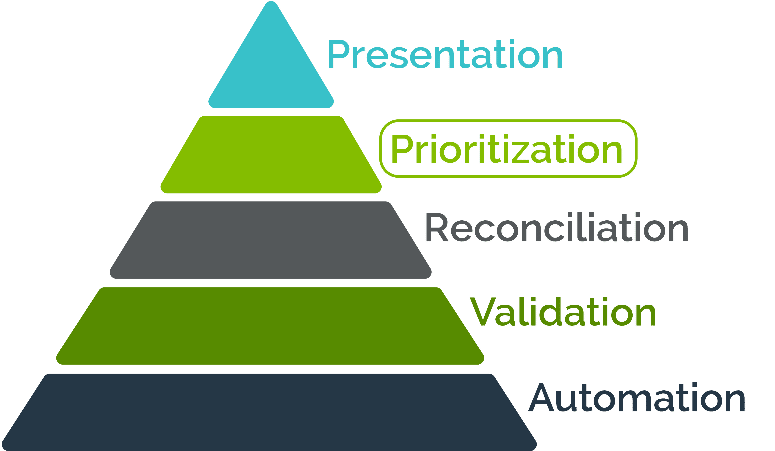

As long as I have been in product and business development for risk adjustment solutions, I find myself always coming back to an iceberg analogy when it comes to solving the business problems of compliance and payment accuracy. Indeed the reaction to the financial consequences of poorly managed risk adjustment operations can seem similar to the shock and awe reactions of hitting an iceberg. Shock and awe reactions are not good strategies for addressing compliance and payment accuracy, but there is hope for avoiding those reactions with a strategy focused on a proactive way to manage risk adjustment operations that minimizes the financial impact of incomplete or inaccurate data. Since the financial success of risk adjustment operations is directly attributable to the completeness and the accuracy of the data that forms the foundation of the operations, we will focus on proactive and actionable data management strategies for your EDPS and RAPS submissions. This includes how to understand from metrics reporting and EDPS/RAPS comparative analysis if your strategies are working well. In this illustration, on the left I have deconstructed the major categories of submissions management activities that comprise the overall risk adjustment program operational strategy.

It is no coincidence that this inverted pyramid resembles an iceberg. At the top, we have the presentation layer of data, which often takes the form of operational dashboards, metrics reports, CMS reports cards and metrics, and other reports that tell us how we are doing operationally and financially. But the presentation is only as good as the data management activities that precede it and form the base of the operations, and we never want to be surprised by what is presented to us and then feel like we’ve hit an iceberg. Thus, in this article I’ll discuss “working backwards” and “working forwards” for operational alignment with best practices that translates into financial success to avoid hitting an unexpected iceberg. I’ll illustrate how to use data submission best practices to move from a reactive to a proactive approach to submissions management as the RAPS to EDPS transition continues, and how to use EDPS and RAPS comparative analysis to develop your own actionable plan for the prioritization of risk score gap closure activities.

It’s this “prioritization” level upon which we’ll focus most of our attention in this article, because when it comes right down to it these analytics are used to prioritize EDPS and RAPS gap closure activities from most impactful to least impactful, especially as sweeps deadlines draw near. In keeping with the events of the day, closure will be our theme, and let us begin with a brief history lesson.

We’ve Come a Long Way, Baby

I thought it would be helpful to take a few moments and set the stage for our discussion with a brief history lesson. Hopefully, for most health plans their history during the transition from RAPS to EDPS does not include a financial disaster of Titanic-like proportions, but I do know that this year’s Final Notice for PY2021 and historical trending based on client metrics and report cards indicates that we’ve come a long way since 2012 when EDPS began. In the beginning, the gap between EDPS and RAPS risk scores was upwards of 26% according to a study done in 2015.

In contrast, in the recently released PY2021 Final Notice, on page 66 CMS reports that their analysis of EDPS and RAPS continues to show that when comparing RAPS-based risk scores calculated using the 2017 CMS-HCC model to encounter data-based risk scores calculated using the 2020 CMS-HCC model, the difference is “negligible”. It is important to also point out that the closure of the gap between EDPS and RAPS since 2012 is largely due to recommendations resulting from three prior GAO audits for the provision of reporting and metrics by CMS that supports the development of more actionable data quality management strategies for submitters. Smart health plans accomplish this by aligning their own operational processes with these metrics. This alignment will be even more important as our industry continues the journey to 100% of the risk score calculated upon the more complex EDPS data, and eventually HEDIS measures calculated using encounter data, as was announced last October via HPMS.

In fact, on page 64 Section M. Encounter Data as a Diagnosis Source for 2021 of the PY2021 Final Notice, CMS stated that a majority of commenters agreed with CMS’ proposal to increase the blend to 75% EDPS, while only a few commented to keep it at 50%, and one commented that CMS do away with EDPS altogether. Doing away with EDPS is likely not going to happen since we are now eight years into this transition and RAPS was supposed to have originally been phased out by 2015. Also, plans are likely tiring of supporting the operational and financial overhead attributable to RAPS, especially in light of the fact that the gap between EDPS and RAPS has narrowed significantly to “negligible”. It stands to reason that the transition to 100% EDPS will likely be concluded at the latest by 2023, so the time is now to optimize your risk adjustment operations. By now, and certainly by 2023 or whenever RAPS is finally sunset, health plan submitters are used to the greatly expanded data requirements for the X12 837 used for EDPS, as evidenced by the closure of the gap from 26% in 2015 to “negligible” in present day. Here at Centauri, we conduct this important EDSP/RAPS analytical work on behalf of our clients. We go the extra mile not just to identify revenue-impacting gaps, but to also recommend strategies for closing them based on the plans’ unique combination of people, processes and technology for risk adjustment operations.

Working Forward

So now that our brief history lesson has concluded, our focus now turns to actionable operational strategies for gap closure to avoid a financial iceberg. To keep it simple, I refer to the development and implementation of proactive gap closure strategies as a two-pronged approach, which are creatively named “working backward” and “working forward”.

The “working backward” part is the EDPS and RAPS comparative analytics that are the focus of this article, but it is important to preface that discussion with how we “work forward”. Many in the audience probably remember back in June 2017 when CMS published an HPMS memo that outlines, from their perspective, a list of 12 best practices for encounter data submission. This memo serves as a useful “road map” for the more important activity of developing and implementing actionable strategies given a plan’s unique people, processes and technology. If you employ these, you should never be surprised by what is on your report cards or operational metrics reports and you will thus optimize your chances of avoiding that financial iceberg. Another important aspect of “working forward” I mentioned earlier, and that is aligning your operational processes with CMS operational metrics. To do that you will need to understand how to interpret the CMS quarterly report cards, and work backwards by root cause analysis to determine how to address the core issue. This analysis is often cross-functional within the organization and whoever leads the analysis will need to be empowered with a strategic plan for proactively engaging and effecting change.

Working Backward

Now that we have talked about operational reporting, let us shift our focus to financial reporting and “working backwards”. As long as there is a requirement to submit EDPS and RAPS data in parallel, there will be a need to perform comparisons between the two to ensure that both streams are complete and accurate. The whole point to collaboratively “working backward” is to shift from a reactive approach, which is usually characterized by mass panic when reporting is released or mad scrambling prior to a sweeps deadline, to a proactive approach, which is characterized by the lack of panic and scrambling. Therefore, choose or develop tools that do not just highlight the gaps, but also make it easier for you to identify effective and efficient strategies for closing the gaps along with engaging the right stakeholders. To be able to perform these comparative analytics requires a certain skill set, as does being able to mobilize the crossfunctional committee of stakeholders who can develop an actionable plan for addressing any gaps in an efficient manner. The efficiency comes with the “prioritization” part of the operational pyramid illustrated earlier, and also acknowledging that this cannot be just punted over into the IT department for them to do with no business guidance. This type of comparative analysis should be the main driver of prioritizing the development of strategies for addressing gaps from most impactful to least impactful. It is important to point out not to delay this comparative analysis until right before a sweeps deadline – this analysis should be iterative on at least a monthly basis. Action plans should be monitored for positive trends in the reduction of missing HCCs and their associated revenue. The key stakeholders you’ll need in order to make this intelligence truly actionable are the following:

- Those with risk adjustment specialty analytics expertise (inclusive of suspecting) in order to perform the MAO-002 to MAO-004 comparisons and categorize the root causes of the differences,

- Claims and electronic data interchange SMEs, who are necessary for researching and developing strategies for addressing in the source systems the reasons for CMS rejections of EDPS/RAPS data and are arguably the most important members of the team,

- HEDIS/quality since there is overlap in gap closure strategies and CMS intends to begin calculating HEDIS measures on encounter data as indicated in an October 2019 HPMS memo.

It’s important to note that when considering gaps that there is almost always a difference due to timing, meaning that the report is a snapshot in time and may include submissions of data for which no RAPS returns, MAO-002s or MAO-004s have yet been received. These should be monitored to ensure that they eventually drop off the report. Reports such as these also have drilldown capability so that the individual records pertinent to the scenario can be listed for tracking and trending purposes. The average amount of revenue recapture identified by these reports is directly tied to the completeness and the quality of the data – remember that CMS reported in the PY2021 Final Notice that the gap between RAPS and EDPS is “negligible”.

Also of note are the scenarios that are attributable to rejections. Investigating those requires special expertise as indicated previously, and below is a brief example of how to work backward via root cause analysis for one very common data quality issue: invalid provider NPIs.

Example: High rejection percentage on institutional encounters.

- Root Cause: Invalid billing provider NPI.

- Root Cause: Claims clearinghouse not validating NPIs against current NPPES.

- Remedy if using a claims clearinghouse: Hold the clearinghouse accountable for data quality and ensuring that they are validating NPIs against NPPES, which is a free monthly download from CMS.

- Remedy if the claims department receives claims directly: You will have to analyze another level further to find out why they are not validating NPIs in addition to determining if internal provider systems are in alignment with NPPES data. Are the claims of paper origin? Problems with OCR (optical character recognition)? Other system glitch with extraction?

- Root Cause: Claims clearinghouse not validating NPIs against current NPPES.

In Conclusion

It is my hope that this article helps you to get a better sense of how to deploy your people, processes and technology to align your risk adjustment programs with best practices and employ more proactive operational strategies for addressing EDPS/RAPS data submission compliance and payment accuracy in order to avoid that financial iceberg. If you’d like some assistance with an evaluation of your operations against best practices, or guidance on how you can more effectively work forward and backward, reach out to us at Centauri. Our data submissions team stands ready to help you develop your customized roadmap to optimize your chances for risk adjustment operational and financial success.

Dawn R. Carter

Director, Product Strategy

Centauri Health Solutions, Inc.